Carbon pricing, carbon trading, carbon neutrality, net zero, carbon tariffs, carbon capture, carbon budgets... 16 carbon terms you must know!

2022-10-26

Carbon pricing, carbon trading, carbon neutrality, net zero, carbon tariffs, carbon capture, carbon budgets, carbon sinks, carbon taxes, carbon credits, caps, voluntary carbon markets, mandatory carbon markets... The development of "carbon vocabulary" is like a term on the Internet. As long as you don't pay attention to it for a while, several new ones will pop up.

Are you like Kushina, you haven't paid attention to the issue of global warming for a while, but when you look back, you are already looking at flowers in a fog, and you find that the words in people's mouths are already incomprehensible?

It doesn't matter, the editor has compiled a book called "Concise. "Carbon Dictionary", it takes you three minutes to get started, and it is suitable for chatting about current affairs and showing common sense.

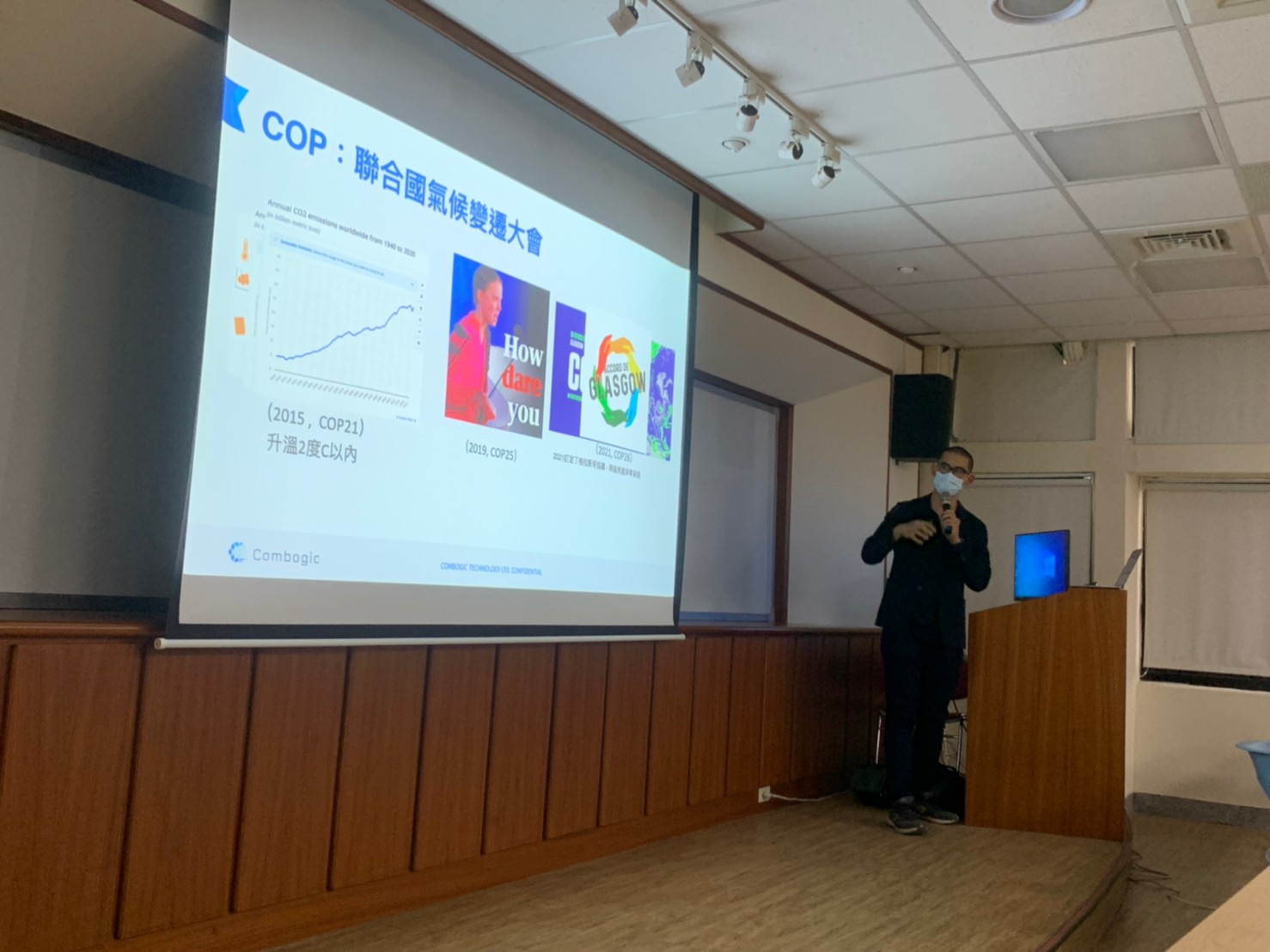

COP26

The full name of COP is Conference of Parties. It is an international conference that the United Nations has held since 1990 in response to climate change. It is called "United Nations Climate Change Conference" in Chinese. COP26 represents the 26th session.

The major milestone of COP26 is the "Glasgow Climate Pact", in which, in addition to reaffirming the 2015 "Paris Agreement", global warming should be controlled within 1.5 degrees, and more than 140 member states have pledged to achieve net zero emissions by 2050 , these member states make up more than 90% of global carbon emissions.

However, due to the restrictions of the epidemic at COP26, the delegations of climate-affected countries could not participate fully, and the study pointed out that even if the goals promised by the countries were fully achieved, the global average temperature would rise to more than 1.8 degrees before the industrial revolution. Although the United Nations Climate Change Conference has made progress, it has also been criticized by the circle.

Net Zero

The complete concept of net zero comes from the outcome of the 2021 United Nations Climate Change Conference (COP26), the Glasgow Convention, which requires the world to achieve a goal of "net zero greenhouse gas emissions" by 2050.

Net zero does not mean that there is no emissions at all, but that the emissions and removals from human activities (absorbed by trees, absorbed by human technology) offset each other, resulting in net zero emissions.

Achieving net-zero emissions by 2050 is a global consensus by the middle of this century, while developing countries are committed to reaching net-zero later. For example, China has committed to net-zero emissions by 2060, and India has committed to net-zero emissions by 2070.

Carbon Neutral

The concepts of "carbon neutrality" and "net zero" are quite close and are often used interchangeably in practice.

However, in terms of inventory, carbon neutral means "CO2 emissions and removals offset each other", while net zero means "in addition to CO2 emissions and removals offsetting each other, there is also a to offset the greenhouse effect”. Net zero is a stricter target than carbon neutrality.

Carbon neutrality can be achieved not only at the global level, but also at the national, corporate and individual levels. For example, when an enterprise can purchase other units of carbon reduction efforts to offset its own carbon emissions and achieve carbon neutrality.

At present, many international companies (Starbucks, Microsoft, Mercedes-Benz, Nike, etc.) have pledged to achieve carbon neutrality goals. Among them, Microsoft even set a goal of completely offsetting all carbon emissions of past companies in 2050. , to become a true zero-carbon enterprise.

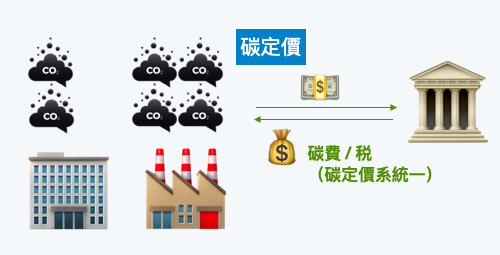

Ok, so carbon pricing is two systems in one package, let's talk about the "carbon fee/carbon tax" part first:

carbon fee, carbon tax

Carbon fee The spirit of carbon tax is well understood, that is, the user pays, similar to the government's collection of fees for air pollution emitting companies.

What is the difference between a "carbon fee" and a "carbon tax"?

Both are based on how much carbon the enterprise emits, how much is charged. This payment is called "fee" or "tax", which is just a difference in legal terms.

For the European Union, the fees imposed on carbon emissions are all classified as "taxes". For Taiwan's administrative system, if the "carbon fee" is implemented, it is a kind of "special public tax", which is levied and levied by the Environmental Protection Agency. The funds in the fund are used for special purposes; if the "carbon tax" is implemented, it will be a general tax, and the levied fees will enter the treasury of the Ministry of Finance, and may be allocated to the defense budget, social welfare, etc.

In April 2022, the Executive Yuan passed the draft amendment to the Greenhouse Gas Reduction and Management Act, officially changing its name to the Climate Change Response Act (the "Climate Law"). The draft amendment to the law clearly stipulates that the “carbon fee” will be the main focus, and the collection will start in 2024 at the earliest.

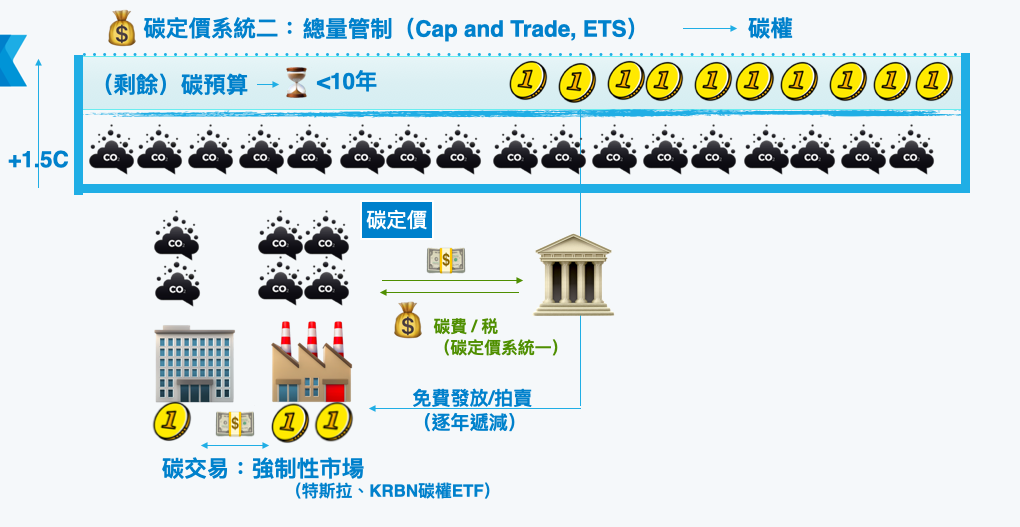

Let's talk about the second system of carbon pricing: cap. Since there is a "total amount", there is a so-called "budget", so there is a "carbon budget".

Carbon Budget

After COP26 passed the Glasgow Agreement, a global consensus has been established: to limit global warming to 1.5 degrees before the industrial revolution by 2050.

Before the global warming of 1.5 degrees, the "deduction" left by humans that can still emit greenhouse gases is the carbon budget, or more precisely, the "remaining carbon budget", because the current global average temperature has reached the level of warming 1.2 degrees, without significant improvement, is expected to use up the remaining carbon budget within a decade.

Cap-and-trade (ETS),Carbon Permit

The spirit of total cap control is to divide the remaining carbon budget into units of tons, and then the control agency (usually the national government) sets the total amount of carbon rights to decrease year by year, and distributes it to major enterprises as "emissions" Permits”, also known as “carbon rights”.

However, in terms of implementation, countries have different means of total cap control, and it is impossible to coordinate and equally share the global remaining carbon budget. Therefore, most of them first set a reduction target, and then reduce the issuance amount year by year to compel domestic companies to reduce carbon emissions. platoon target.

In the initial stage, in order to avoid market shocks, carbon rights were issued for free. In the future, with the gradual increase in carbon pricing and the gradual increase in the cost of carbon emission, the regulatory authority will transform into an annual "auction" of carbon rights.

For example, the EU ETS system until 2021 has about 57 % of carbon rights are sold in auctions , and all proceeds from auctions are used for renewable energy and climate-related purposes.

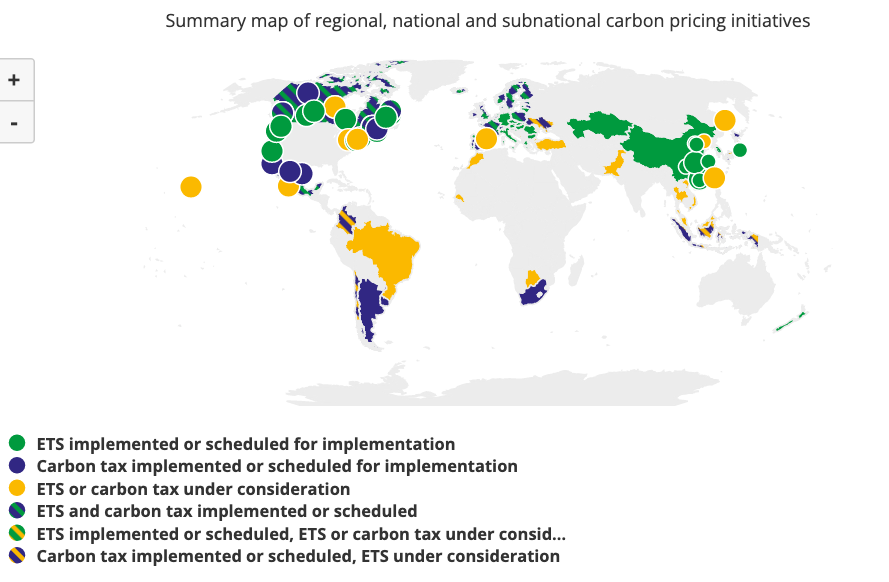

It is worth mentioning that the carbon pricing models adopted around the world are different. Some use carbon tax and carbon fee alone, some use total cap control alone, and some mix and match.

And the above two carbon pricing models are not the only economic tools. The government can also reduce the consumption of fossil fuels by raising oil prices.

For example, Canada has piloted the " Carbon Dividend " (Cap and Dividend) system in four provinces in Canada since 2008 , increase the fuel tax, and the tax revenue is paid in cash to the local people quarterly. at Q3 2022 , a family of four can receive up to $1,079 CAD.

Immigrate to Canada official website here

The outcome of this policy was successful. Statistics It shows that four years after the implementation of the "Carbon Dividend" policy in British Columbia, gasoline sales decreased by 15%, and the regional economic growth was the same as that of the whole country. It is to return the carbon fee income directly to the people, and the carbon dividend policy has won the support of more than half of the people in the region.

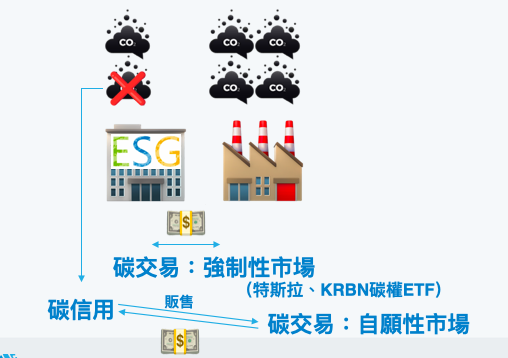

Carbon Trade, Mandatory Carbon Market

The total control system, in addition to budget control to reduce carbon emissions year by year, another spirit is "carbon trading". For example, the full name of the total control scheme implemented by the European Union is "Emission Trading Scheme, ETS", " EU Emissions Trading System".

In this trading concept, the carbon emission rights that the company can obtain is fixed and reduced every year. If the company still cannot achieve the reduction in the short term and needs more carbon rights, it must have excess carbon with others. corporate purchase of rights.

And this purchase is due to government regulations. Enterprises "must" buy, otherwise they will face huge fines, so the market for purchasing carbon rights is also called "Mandatory Carbon Market"

A well-known example of carbon rights trading is the often referred to as Tesla The story of selling carbon rights for profit. In 2015, the European Union began to regulate the carbon emission standards of new cars. If the car manufacturers exceed the standards, they will face a huge fine of 95 euros per gram. Tesla, on the other hand, because of its own electric vehicles, its carbon emissions are far below the standard, so it can sell "unused" carbon rights. In 2021, Tesla’s carbon rights sales revenue will reach 1.46 billion US dollars, accounting for 3% of the total annual revenue.

Speaking of this, what I said above is all "top-down", and the government legislates the rules of the game that companies should do. But this carbon competition also has a "bottom-up" reduction movement, and even a derived trading market.

Next, we will introduce the concepts of "carbon credit" and "carbon offset".

Carbon Credit

The unit of "carbon credit" is the same as the "carbon right" issued by the government, which is ton of carbon dioxide equivalent. It is the "allowable carbon emission quota" allocated by the government from top to bottom.

For example, Xiao Ming opened a "Ming Ming Dyestuff Company". Xiao Ming can initiate a project to replace all machines in the factory with environmentally friendly models, which is estimated to reduce 100 tons of carbon dioxide equivalent per year, and submit this project to the If certified by the regulatory agency, you can obtain a "carbon credit" of 100 tons of CO2.

This carbon credit can also be put on the market and sold to other companies that intend to offset their own carbon emissions. Buying carbon credits sold by others to offset one’s own carbon emissions is called “Carbon Offset”.

The market for buying and selling carbon credits is different from carbon credits because the source of carbon credits is different from carbon rights; and the buying companies are also voluntarily and want to offset their own carbon emissions, which is not mandated by laws and regulations, so it is called a "voluntary market" ( Volantary carbon market).

Compulsory market and voluntary market are usually two sets of systems that do not communicate with each other. For example, in the EU's ETS rules, companies can only apply carbon credits purchased in the international market to a limited extent, and can no longer apply them after 2021.

Carbon Offset

In the spirit of "carbon offset", companies can "offset" their own carbon emissions by purchasing carbon credits generated by other companies and organizations' carbon reduction achievements and negative carbon technology achievements.

The spirit of carbon offset is carried out through corporate funds to support rainforest and peatland restoration projects to help slow down global warming. It is a good intention. However, due to the current lack of supervision, the quality of carbon offset schemes is uneven. In 2016, there were Study investigates more than 5,000 carbon offset programs in the United Nations CDM Clean Development Mechanism and finds that 85% of them fail to meet their stated standards,

The main reason is that most carbon offset programs fail to meet the criterion of "additionality": would the program still proceed without the sale of carbon credits to obtain the funds? That is, after getting the money to sell carbon credits, is there more carbon emission reduction, more carbon dioxide removal from the air...etc.

There are many projects that would have occurred without the capital injection of corporate carbon offsets, and therefore do not have any additional carbon reduction effect. Such fraudulent carbon offset schemes are emerging one after another. Although carbon offsets are well-intentioned, they have been criticized by the group as a means of greenwashing companies because of a large number of loopholes in the scheme.

However, it is impossible for human activities to be completely free of carbon emissions. Carbon offsets will still be an indispensable means of moving towards net zero in the future, and how to address regulation and effectiveness will be a major challenge that must be resolved.

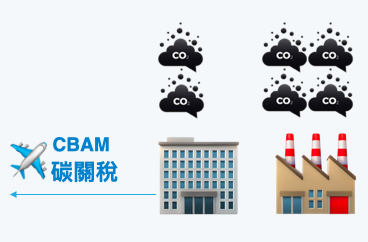

CBAM, Carbon Leakage

Because the carbon price in the EU is very high, but the cost of carbon emissions in other countries is low, in order to avoid "carbon leakage" caused by domestic companies setting up factories in other countries to manufacture and import back, a "carbon border adjustment mechanism" will be established in 2021 ( Carbon Border Adjustment Mechanism, CBAM), colloquially referred to as "carbon tariff".

Actual implementation schedule, importers will be required to declare carbon emissions from 2023, and carbon tariffs on imported products will be officially levied in 2026.

The main purpose of the EU carbon tariff will be used as a climate-related fund, and carbon tariffs paid by vulnerable countries and climate-affected countries will also be returned as the country's climate fund.

Overweight performance, the US Senate also proposed the US version of the Clean Competition Act (CCA), if passed, it will be on the road in 2024, when Taiwan exports 21 US dollars for every 100 US dollars will face carbon tariffs. For Taiwanese exporters, it has become an indispensable survival task to accurately check the carbon footprint of their own products and commit to reducing emissions.

Carbon capture, carbon negative technology: CCUS, BECCS, DAC

Carbon Capture, Utilization and Sequestration (CCUS) is a technology that captures carbon dioxide in the air and stores it in "carbon sinks", such as deep oceans, under the crust, and in trees and plants. The goal of this type of technology is to generate "negative carbon emissions", so it is often referred to as "negative carbon technology".

The most common carbon capture technology is planting trees. Nature-oriented silviculture, peatland maintenance, rainforest maintenance, and more.

Artificial technologies include technologies and activities that directly remove carbon dioxide from the air, such as CCUS, which directly collects carbon dioxide from carbon emission sources (such as petrochemical plants and thermal power plants), and "direct carbon dioxide" which directly absorbs carbon dioxide from the air. capture” (DAC), or carbon capture technology for biomass energy (BECCS).

The focus of carbon capture is simplicity and intuition. If there is too much carbon dioxide in the air, it will be collected. The captured carbon dioxide can be permanently stored under the surface, with a low risk of leakage.

But carbon capture is expensive and the technology is immature. In the United States, carbon capture technology is also expensive to develop. In order to maintain the operation of the project, a lot of the captured carbon dioxide is sold to oil companies to pressurize oil fields, activate old oil wells, and then extract more oil. Group criticism.

What is certain is that carbon-negative technology is one of the indispensable means to achieve net zero by 2050 in the future. How to overcome technical barriers and reduce costs is a major issue in this field.

ESG

The ESG mark was first proposed at the United Nations in 2005. The full name is Environment, Society, Government, environment, society and governance. responsibility.

The biggest difference between ESG and CSR in the past is that CSR only emphasizes vague "social responsibility", and does not specify the details of the so-called responsibility. In addition to being divided into three aspects, ESG can also be combined with the 17 criteria of the United Nations Sustainable Development Goals (SDGs) to subdivide the specific categories of "social responsibility".

Since it can be subdivided and specific, it can be evaluated. The most important point of ESG is that it has successfully moved beyond a PR slogan to become a qualitative measure of corporate performance.

And this indicator has also stood the test of time: in the past, under the impact of the 2008 financial tsunami and the 2020 epidemic, Data shows that companies with higher ESG scores do have a better ability to cope with challenges and show higher corporate resilience than average companies. Therefore, in recent years, ESG mark certification, sustainability reports, and transparency of corporate information disclosure have gradually become one of the selection criteria for investment institutions.

Extended reading: "👌About ESG, an article makes it clear"